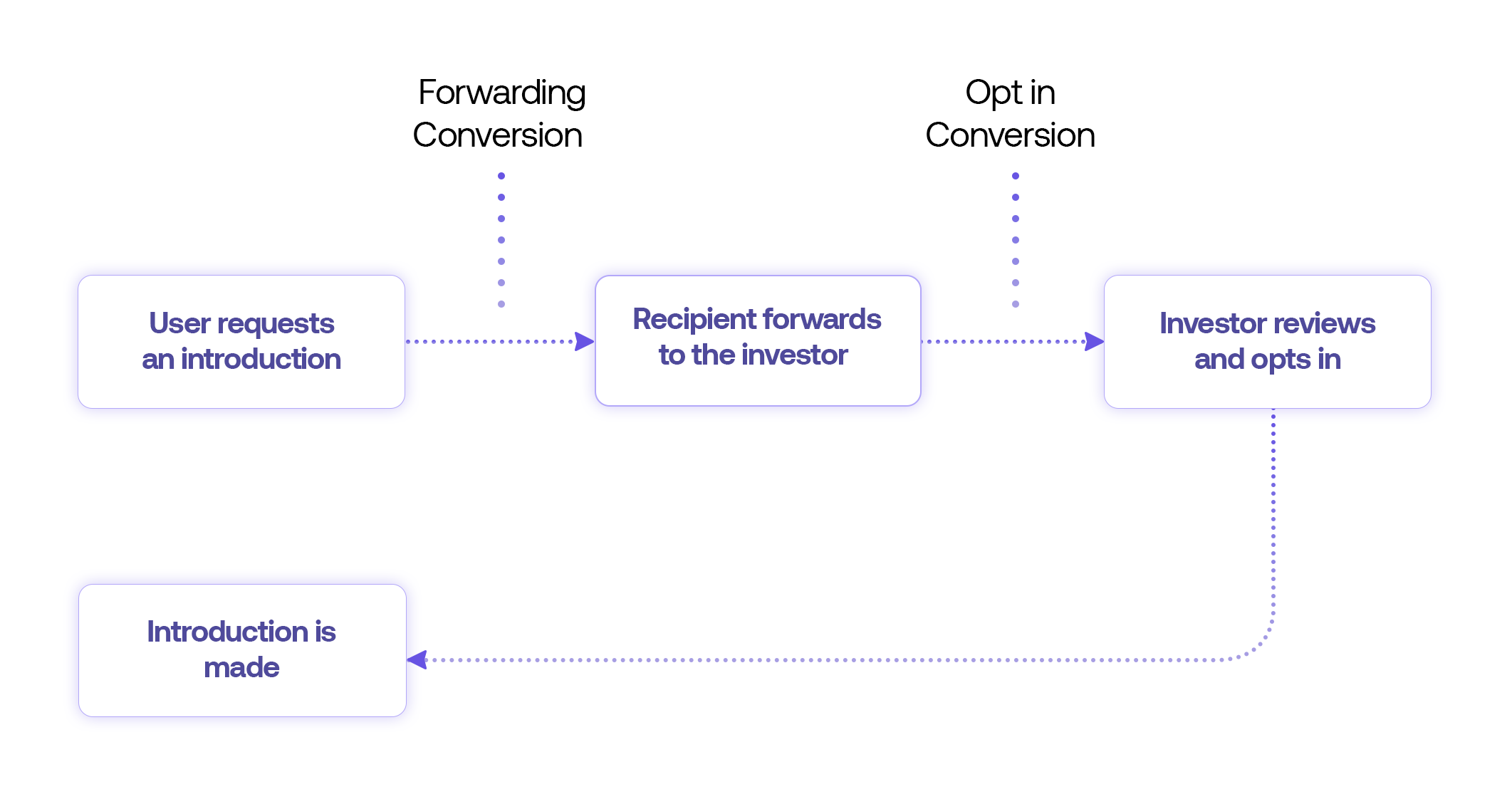

Adam forwards the request to Investor X

Forwarding conversion depends on how compelling the recipient perceives your request to be. Is this a Company that the investor is likely to be interested in? Is the communication representative of the top cohort of founders?

Investor X opts in to the introduction

Opt-in conversion depends on the level of interest that your introduction request is able to generate with the investor in question. This depends on a broad range of factors, including how well your Company fits with the stage and the sector of the investor in question.

Forwarding Conversion

The percentage of intro requests that are actually forwarded to the target investor.

Opt-In Conversion

The percentage of forwarded intro requests whereby the investor opts in to the introduction.

Well-Researched Intro Requests

Through the language of the introduction requests, users can demonstrate their level of research by indicating what makes the investor a strong fit. The below table outlines various ways to do this:Similar Investments

Users can reference a given investor’s prior investments that are particularly similar to their business. See details here on how to identify similar investments efficiently.

Sector Focus

Users can indicate the percentage of the investor’s total investments in their parent sector (I.e. Consumer, or B2B Software). This information is easily available within investor profiles on the Metal platform.

Personalized Requests

Users should avoid mass or bulk emails, and instead should personalize each request. This takes time and effort, but yields much stronger results. The two most common types of personalizations are noted below:| Specific to the Person | Include some piece of content in the intro request that is unique to the recipient, or the user’s relationship with them. |

| Company Specific | Include some aspect of the recipient’s company to make the request personalized. |

Useful Templates

Scenario: Via Metal, the user looked up the portfolio founders for her target investor. Via the LinkedIn and Gmail integration, the user was able to identify a few portfolio founders that she knew from her prior work experience.Intro Request -- Example #1

It’s been a few years; I hope you’re well. I noticed you started Company X and raised a seed round from ABC Ventures. I recently launched Bonotos, offering accounting software for month-end closing, and we’ve achieved within 10 months.

ABC Ventures seems like a great fit for us. They focus on seed investments (30%+ of total portfolio) and , and recently invested in Optima which operates in our space and offers accounting software for a different but adjacent problem.Would you be open to potentially introducing us to ABC Ventures?

ABC Ventures seems like a great fit for us. They focus on seed investments (30%+ of total portfolio) and , and recently invested in Optima which operates in our space and offers accounting software for a different but adjacent problem.Would you be open to potentially introducing us to ABC Ventures?

Intro Request -- Example #2

Thanks for offering to make potential introductions for our upcoming raise. As per our preliminary research, we have identified Investor X as a particularly strong fit. They have made and have been particularly active in our sector.

I noticed that one of your portfolio companies, Company X, has previously raised from Investor X. If possible, we would love an opportunity to chat with the founders at Company X to learn about the process, and to potentially get an introduction with Investor X.Would you be open to seeing if the founders at Company X are open to connecting with us over a quick 15-min call?

I noticed that one of your portfolio companies, Company X, has previously raised from Investor X. If possible, we would love an opportunity to chat with the founders at Company X to learn about the process, and to potentially get an introduction with Investor X.Would you be open to seeing if the founders at Company X are open to connecting with us over a quick 15-min call?